Unlock Classroom Prosperity: Boost Learning With Classroom Money!

Classroom Money: Teaching Students Financial Literacy

Greetings, Smart People! In today’s digital age, it is essential for students to acquire not only academic knowledge but also practical life skills. One crucial skill that often goes overlooked is financial literacy. It is never too early to start teaching children the value of money and how to manage it responsibly. That’s where the concept of classroom money comes into play. In this article, we will delve into the details of classroom money, its benefits, and how it can shape the future of our young learners.

Introduction

Financial literacy is the ability to understand and use various financial skills, including personal financial management, budgeting, and investment. By introducing classroom money, educators can create a simulated environment where students can develop these skills in a practical and engaging manner.

3 Picture Gallery: Unlock Classroom Prosperity: Boost Learning With Classroom Money!

Classroom money is a form of play money that teachers use as a tool to educate students about financial concepts and responsibilities. It can be earned, saved, and spent within the classroom community, allowing students to experience real-life scenarios in a safe and controlled setting.

By incorporating classroom money into the curriculum, teachers can empower their students to make informed financial decisions, develop critical thinking skills, and cultivate a sense of responsibility towards money management.

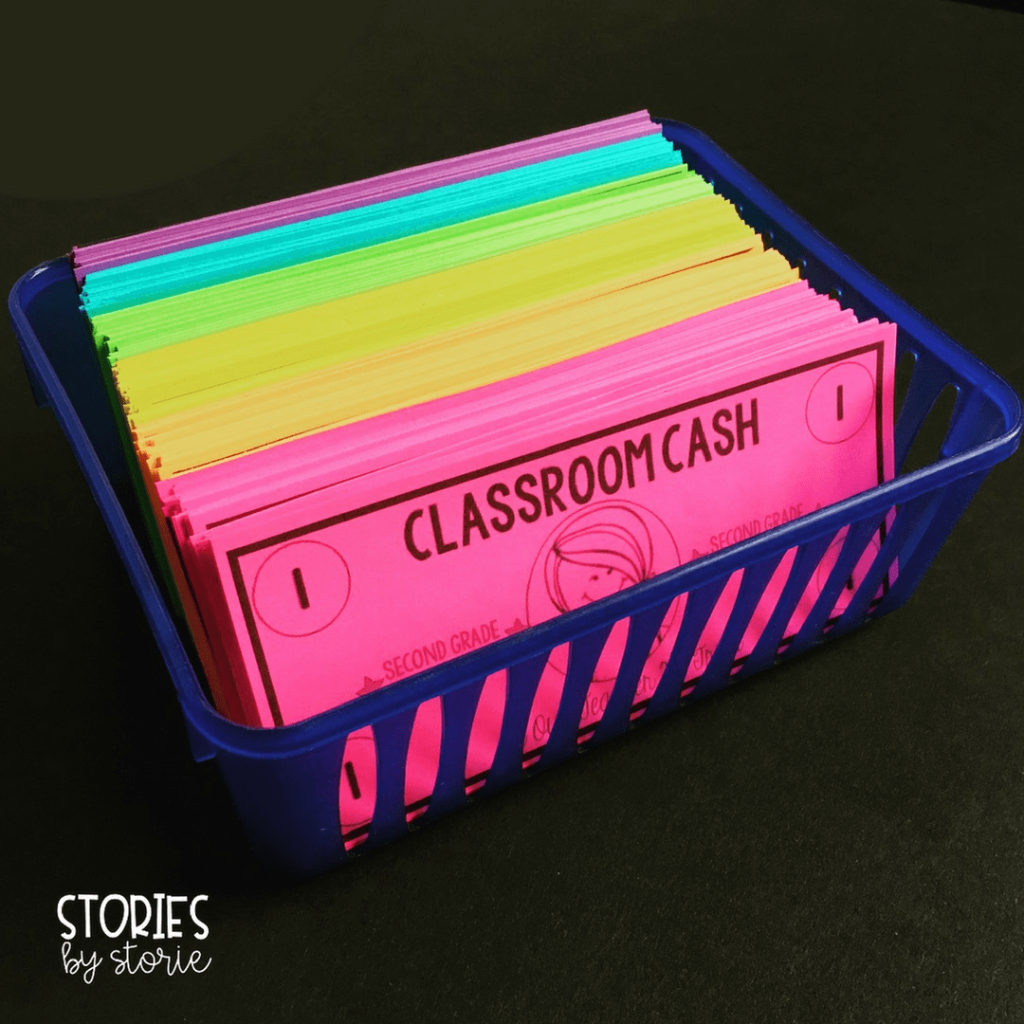

Image Source: i0.wp.com

Now, let’s dive deeper into the what, who, when, where, why, and how of classroom money!

What is Classroom Money?

Classroom money is a form of currency used within the classroom environment. It is a tool that allows students to learn about financial literacy through hands-on experiences. This play money resembles real currency and can be used to teach various financial concepts, such as earning, saving, budgeting, and spending.

Paragrahp 1

Classroom money provides students with a tangible representation of the value of money and how it is earned and spent.

Paragrahp 2

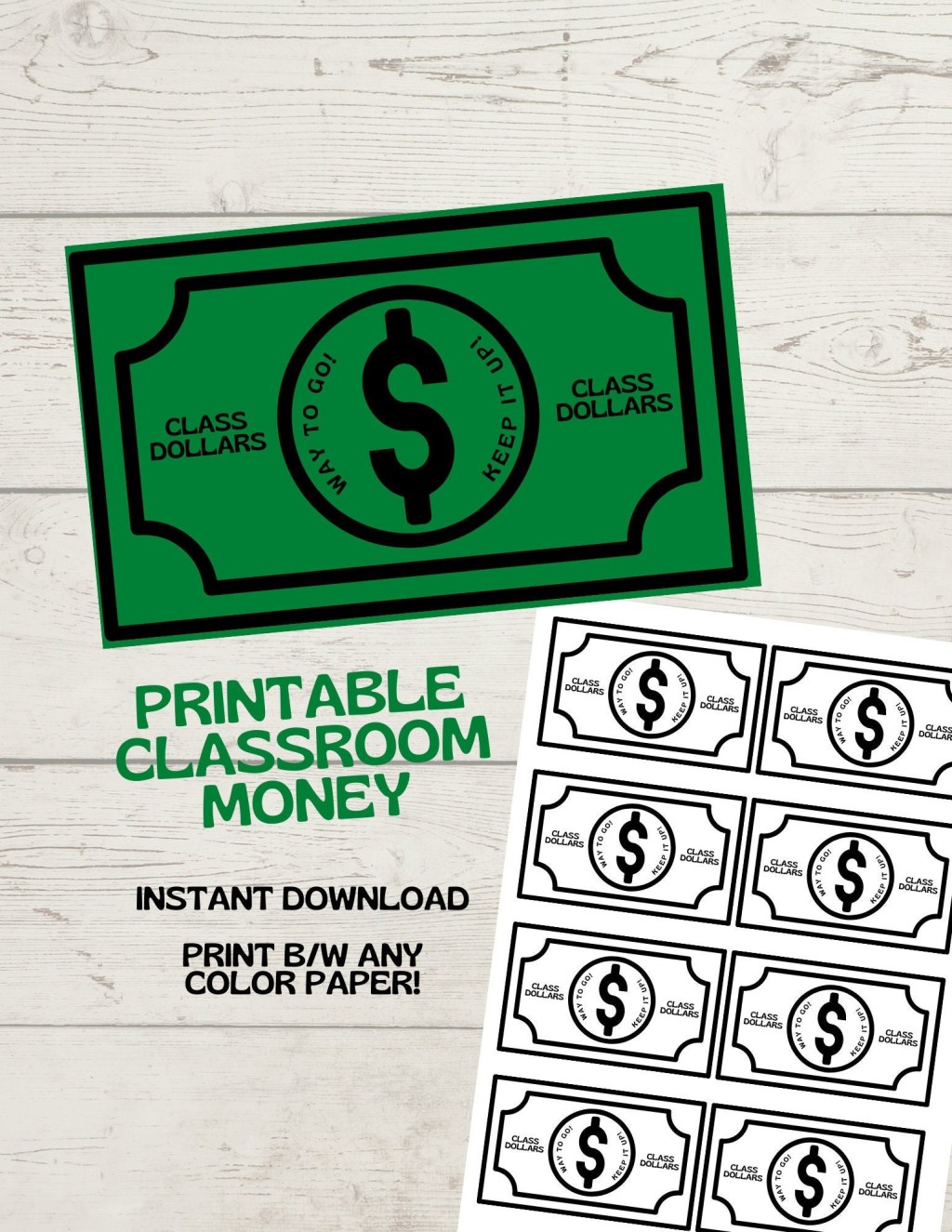

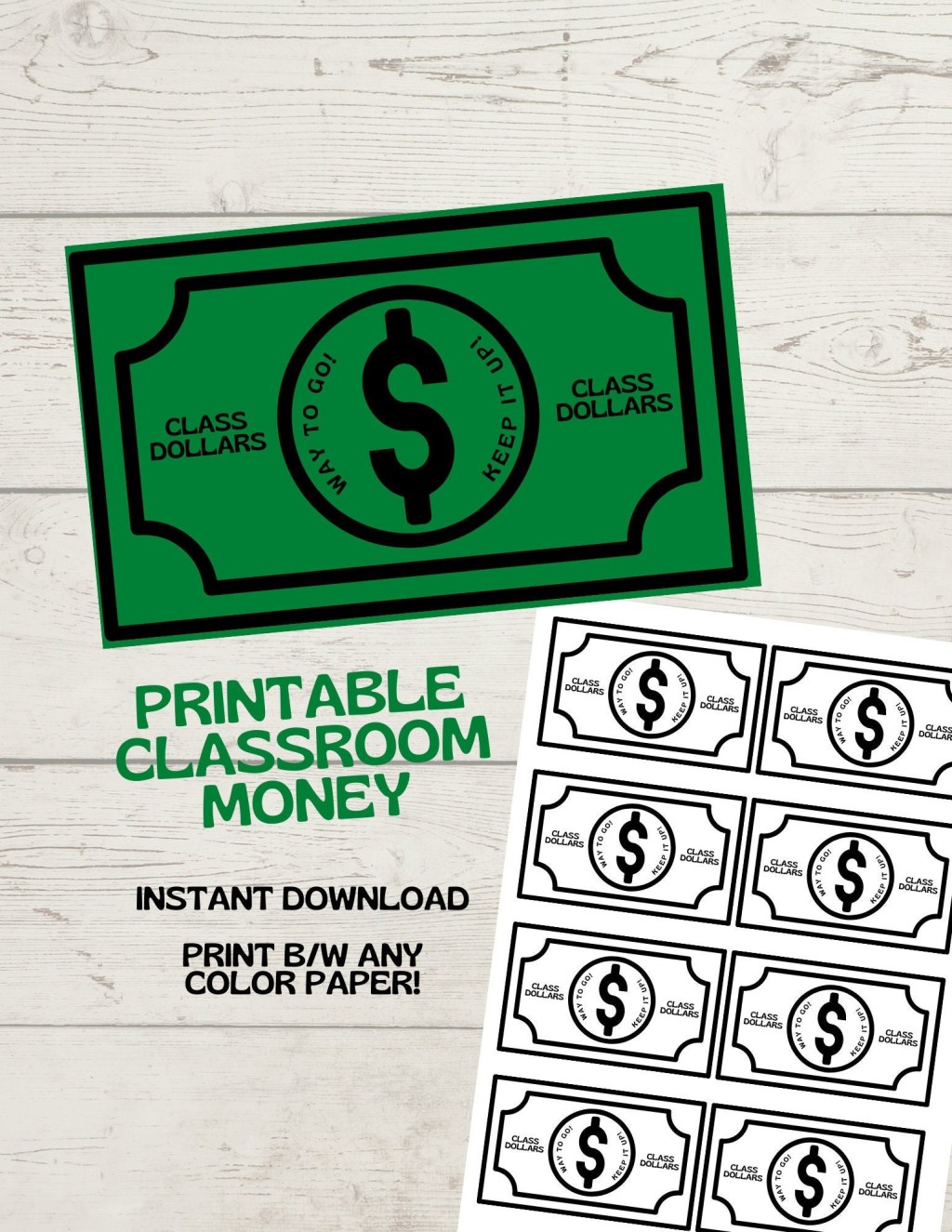

Image Source: leapoffaithcrafting.com

It can be in the form of paper bills, coins, or even digital currency, depending on the preference of the teacher.

Paragrahp 3

Teachers can create their own currency system or use existing ones, such as ClassCash or EduBucks.

Paragrahp 4

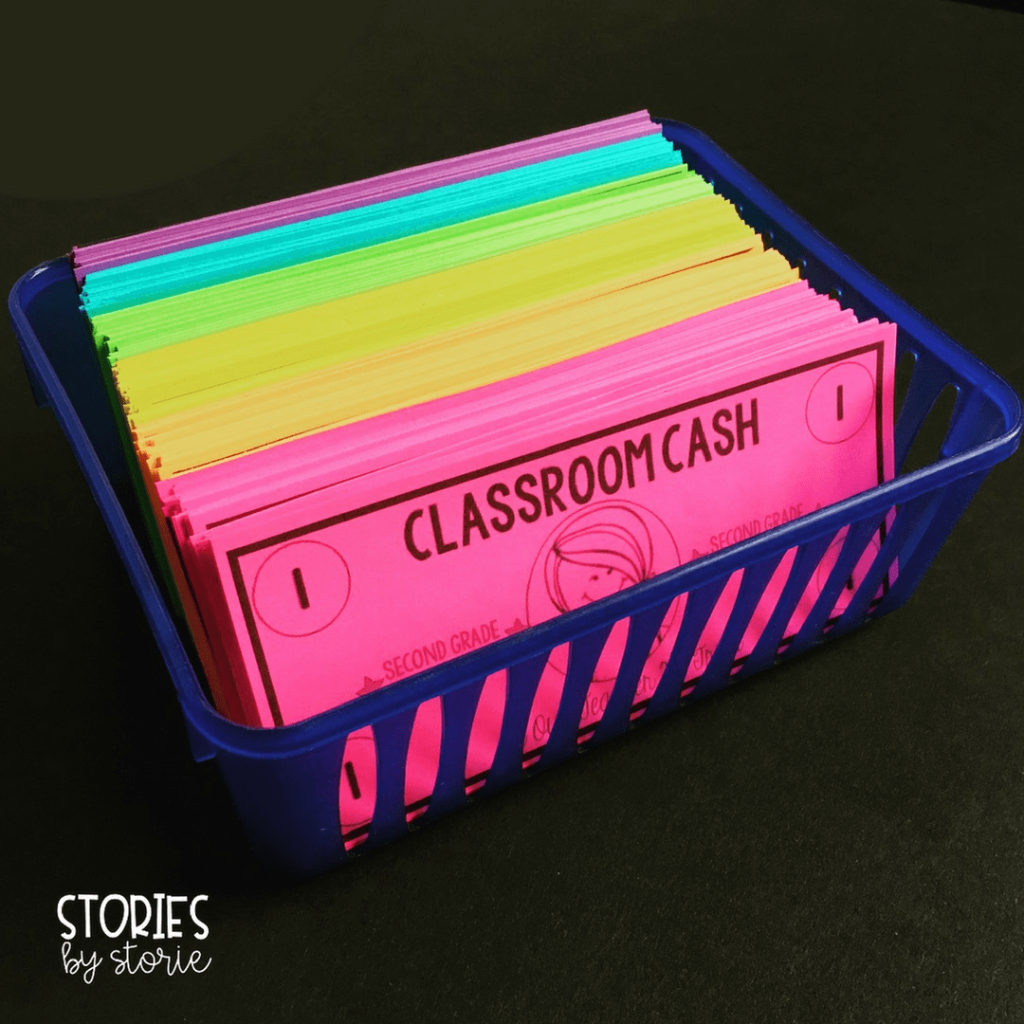

Image Source: etsystatic.com

Students can earn classroom money through various activities, such as completing assignments, participating in class discussions, or demonstrating good behavior.

Paragrahp 5

This currency can then be used by students to purchase rewards, participate in auctions, or even pay rent for their classroom desks.

Paragrahp 6

Classroom money systems can be tailored to fit different grade levels and subjects, making it a versatile tool for educators.

Paragrahp 7

Overall, classroom money serves as a practical and interactive way to teach students about financial literacy.

Who Can Benefit from Classroom Money?

Classroom money is not limited to a specific age group or educational level. It can be implemented in both primary and secondary schools, catering to the needs of students at different stages of their academic journey.

Paragrahp 1

Elementary school students can benefit from classroom money by learning basic financial concepts, such as the value of coins, counting money, and making simple purchases.

Paragrahp 2

Middle school students can delve deeper into financial literacy by understanding more complex concepts, such as budgeting, saving, and investing.

Paragrahp 3

High school students can apply their knowledge of classroom money to real-life situations, such as managing personal finances, making informed consumer choices, and preparing for future careers.

Paragrahp 4

Special education students can also benefit from classroom money, as it provides a visual and interactive tool to grasp financial concepts.

Paragrahp 5

Ultimately, classroom money is a valuable resource for any educator seeking to equip their students with essential financial skills.

When and Where to Use Classroom Money?

Classroom money can be used throughout the school year, integrated into various subjects and activities. It can be implemented both in traditional classrooms and online learning environments.

Paragrahp 1

Teachers can incorporate classroom money into math lessons, teaching students how to count and make change using play currency.

Paragrahp 2

It can be used during role-playing activities, where students simulate real-life scenarios, such as running a business or managing a household budget.

Paragrahp 3

Classroom money can also be utilized during social studies lessons, exploring economic concepts, and understanding the financial impact of historical events.

Paragrahp 4

Various school-wide events, such as fundraisers or charity drives, can incorporate classroom money as an incentive to encourage student participation.

Paragrahp 5

Whether in physical or virtual classrooms, the versatility of classroom money makes it adaptable to any educational setting.

Why Classroom Money?

Classroom money offers numerous benefits for both students and educators, making it an invaluable addition to any curriculum.

Paragrahp 1

First and foremost, classroom money instills financial literacy skills in students from a young age, preparing them for real-world financial challenges.

Paragrahp 2

It promotes hands-on learning, allowing students to actively participate in their financial education.

Paragrahp 3

By earning and spending classroom money, students develop a sense of responsibility and accountability for their financial decisions.

Paragrahp 4

Classroom money fosters critical thinking skills, as students must make informed choices about how to allocate and manage their resources.

Paragrahp 5

It encourages teamwork and collaboration, as students can engage in group projects or business ventures using classroom money.

Paragrahp 6

Classroom money also creates a positive classroom environment, as students are motivated to achieve academic excellence and demonstrate desirable behavior to earn rewards.

Paragrahp 7

Ultimately, classroom money bridges the gap between theoretical knowledge and practical application, equipping students with skills that will benefit them throughout their lives.

How to Implement Classroom Money?

Implementing classroom money requires careful planning and consideration to ensure its effectiveness and relevance to students’ learning objectives.

Paragrahp 1

Start by determining the currency system you want to use, considering factors such as your students’ age, curriculum, and classroom dynamics.

Paragrahp 2

Designate specific ways for students to earn classroom money, such as completing homework assignments, demonstrating exemplary behavior, or achieving academic milestones.

Paragrahp 3

Create opportunities for students to spend their classroom money, whether through a class store, auctions, or rewards system.

Paragrahp 4

Periodically review and adjust your classroom money system to ensure it remains engaging and relevant for your students.

Paragrahp 5

Consistently reinforce financial literacy concepts and encourage discussions around money management to deepen students’ understanding.

Paragrahp 6

Collaborate with parents and guardians to reinforce classroom money lessons at home, fostering a holistic approach to financial education.

Paragrahp 7

Remember, the success of implementing classroom money lies in its integration with the overall curriculum and its alignment with the specific needs and goals of your students.

Advantages and Disadvantages of Classroom Money

Like any educational tool, classroom money comes with its own set of advantages and disadvantages. Let’s explore both sides of the coin.

Advantages

Paragrahp 1

Classroom money provides a hands-on and interactive approach to financial education, making learning engaging and memorable.

Paragrahp 2

It fosters a sense of responsibility and accountability in students, teaching them the consequences of their financial decisions.

Paragrahp 3

Classroom money promotes critical thinking and problem-solving skills, as students must strategize how to earn and spend their resources wisely.

Paragrahp 4

It creates a positive classroom culture, as students are motivated to work towards academic success and desirable behavior to earn rewards.

Paragrahp 5

Classroom money allows students to make mistakes and learn from them in a safe and controlled environment, preparing them for future financial challenges.

Disadvantages

Paragrahp 1

Introducing classroom money requires time and effort from teachers to design and implement an effective system tailored to their students’ needs.

Paragrahp 2

It may pose challenges in managing student expectations and ensuring fairness in distributing and redeeming classroom money.

Paragrahp 3

Some students may become overly focused on earning classroom money, compromising their engagement in other aspects of their education.

Paragrahp 4

Classroom money systems can sometimes reinforce a materialistic mindset, emphasizing the value of tangible rewards over intrinsic motivation.

Paragrahp 5

It is crucial for teachers to continually assess and adapt their classroom money system to address any potential disadvantages and maximize its benefits.

Frequently Asked Questions about Classroom Money

1. Is classroom money suitable for all grade levels?

Yes, classroom money can be adapted to fit various grade levels and subjects, making it suitable for students of all ages.

2. Can classroom money be used in online learning environments?

Definitely! Classroom money can be used in both physical and virtual classrooms, allowing students to learn about financial literacy regardless of their learning environment.

3. Does classroom money replace traditional teaching methods?

No, classroom money is not meant to replace traditional teaching methods but rather complement them by providing hands-on learning experiences.

4. How can parents support classroom money lessons at home?

Parents can reinforce classroom money lessons by involving their children in real-life financial activities, such as budgeting, saving, and making informed purchasing decisions.

5. Does using classroom money guarantee financial success?

While classroom money instills financial literacy skills, its impact on long-term financial success depends on various factors, such as individual financial habits and external economic conditions. It serves as a foundation for responsible financial decision-making.

Conclusion: Empowering Students for a Bright Financial Future

Now that you understand the ins and outs of classroom money, it’s time to take action. As educators, it is our responsibility to equip students with the knowledge and skills they need to navigate the complex world of personal finance. By implementing classroom money, we can create a dynamic and interactive learning environment that nurtures financial literacy and cultivates a generation of financially responsible individuals.

So, what are you waiting for? Start integrating classroom money into your curriculum today and watch your students thrive in their financial journey!

Final Remarks

Financial education is a lifelong journey, and classroom money is just one tool in the toolbox. While it provides a hands-on approach to financial literacy, it is important to complement it with real-world experiences and ongoing discussions about money. By working together as educators, parents, and communities, we can empower future generations to make informed financial decisions and build a stable and prosperous future.

This post topic: Classroom